Gro AMA with Chadly

Primer: Chadly from CRE8R DAO speaks with Joyce from Gro Protocol in a recent Twitter Spaces, covering Gro’s design philosophy and thought process behind their decisions. They covered a wide variety of topics, including the philosophy of Gro Protocol, their products, and what they are hoping to achieve in the DeFi ecosystem.

Why Is Their Team Doxxed?

In Web3, there’s this notion that people can be pseudonymous and be judged on the skills they bring

Gro does things differently — all of their team member profiles are available

Wants to make sure everyone understands that this is a team with real human beings involved and to build trust with users

Gro’s target audience is people who are newer to the DeFi space. These people are more used to traditional finance where knowing the identity of the team gives them more assurance

The Inception Of Gro Protocol And The Milestones Achieved

Started their private beta last July

Have been communicating to people about what Gro offers and to ensure everything is safe and secure

After a month of testing with experienced DeFi users, they broadened it into a public beta

Have reached a few milestones:

In Sep 2021, they did an LBP on Balancer to distribute their governance tokens. That was the moment when they became a DAO

In Dec 2021, they launched their Labs product on Avalanche

Partnership with Argent Wallet

In January, they partnered with zkSync

Launched a vesting rewards program where everyone would get a chance to decide whether they want to vest their tokens for a full 12 months or to take them out

“And everyone who participated in the LBP got hold of governance tokens that they can use to vote for the future of Gro protocol, which I think is a watershed moment. Because from that point, every decision we have made goes through DAO governance.”

- Joyce Chin

Focus On Mitigating Risks

They approach it from 2 standpoints:

Ideological

Practical

From a practical standpoint, they are in an industry where everyone expects high growth

Slowly opening up their products to the wider public allows them to flush out the design issues and potential bugs

From an ideological standpoint, gatekeeping access prevents too many people from apeing into their products without understanding the risks

Thoughts On Decentralization

The crypto space is about openness, accessibility, and composability

As the whole space grows larger, “decentralized finance” will one day just become “finance”

To bring DeFi mainstream, they need to meet people where they are

Their documentation and dashboard make it very transparent for users to know what strategies are used and where their assets are allocated to

As for risks, they have taken the responsibility to make sure everything works. They have funded bug bounties on ImmuneFi and have completed multiple audits of their protocol

Why Does Gro Need A DAO?

They want to be decentralized

This allows them to tap into people who have different exposure and connections to other protocols and DAOs to help them grow

Decentralization is a process. Important to make the right decisions about when to decentralize and the pace of decentralization

Did not want complete decentralization upfront as there would be no one to help steer the protocol at the beginning

Trust takes time to build. They want to earn trust from their users and community members and sustain it

In Oct 2021, Cream Finance was exploited and Gro had 2 of its strategies allocated to Cream. That was one month after they have launched the GRO token and Gro DAO

They managed the crisis by answering questions from the community and publishing a post-mortem of the incident

One of their key learning points is that they really need to scrutinize the different strategies that they are allocating. They came up with a yield selection framework with many factors to examine

“So I think being decentralized would help us make sure that we are getting the different people's voices, a very diverse opinions into the development of the protocol.”

- Joyce Chin

Launch On Avalanche

Initially, they launched on Ethereum Mainnet. Back then, gas fees were high

Realized that this was very painful for users and that they had to find an alternative

Their community suggested that they should launch on Avalanche and they shifted there

Avalanche was great as transaction costs were only a few cents

They are trying to bring sustainable yields that come from stablecoins only

They provide the yield sources separately to give users transparency

Focus On Security

One of the pillars of Gro Protocol is “Safe and Secure”

One of the votes they had as a DAO was to put in additional resources to have Trail of Bits audit their protocol

They have enlarged their bounty on ImmuneFi to a million

It’s important for them to offer similar levels of safety and security as to what TradFi offers

Labs

Their leveraged yield farming product on Avalanche

User deposits will be used to borrow more funds to be put into a yield farm. Currently, the yield farm is on Trader Joe

Labs earn the trading fees and governance token incentives from doing so

Users could do the same thing that Labs does manually. However, it is very tedious to do it manually

Besides being tedious, users would have to watch out for liquidations and impermanent losses if they do it manually

Labs automate these processes and users do not have to manage them on their own

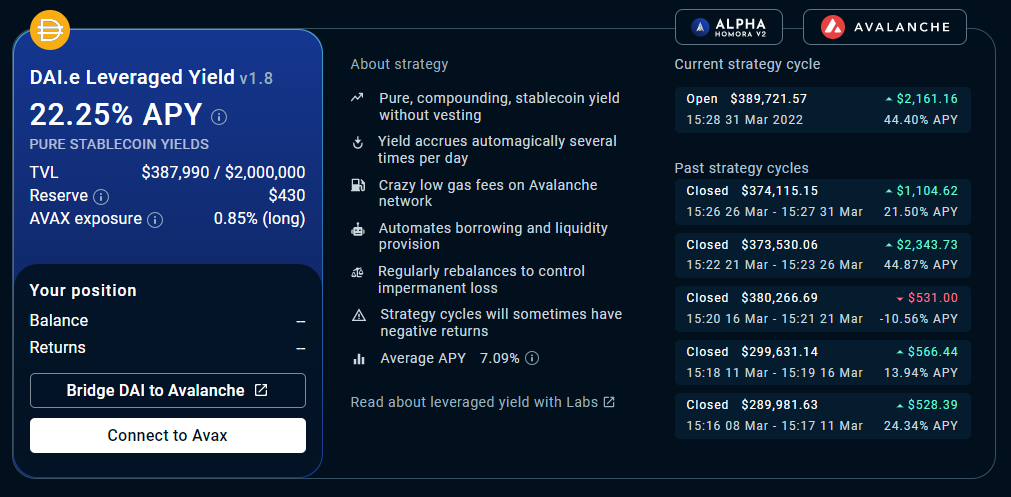

Dashboard On Labs

It displays the APY and the 5 most recent strategy cycles:

The returns

How long each cycle would last

Once they have run those strategies for long enough, they intend to bring more risk/return metrics

This gives users an easy way to benchmark, given the risks they are taking

A lot of their team members came from traditional finance. In TradFi, there is a lot of consideration that is paid to risks

“We also have users that will come into Discord and simply ask, well, Labs looks great, but what are the risks, because people will often think correctly that there's no free lunch, there should be some risk involved when you're looking at something extraordinary, extraordinarily attractive.”

- Joyce Chin

Being transparent with users as to the risks helps build up trust

Focus On Making DeFi Accessible

To bring new people who are not used to the volatility into this space

Their job is to bring more options to the table and make DeFi more accessible to people

Many of their users have asked for fixed-rate products and this is now on their roadmap

Working with Element Finance to see how they could bring fixed rate products for those who want certainty in yield

GRO Token And Governance

The parameters of the Gro Protocol are governed by token holders through votes

Initially, the protocol did not have performance fees at all. Token holders ended up proposing and voting for a 5% performance fee on the yield generated

They have gone through voting as to whether they should do the Olympus Pro way for them to earn more protocol owned liquidity

With the resources in the Treasury, they have gone through votes on their marketing budget

They are currently going through a vote where they are transferring more of the costs from their UK legal entity to the DAO

Currently, the gas costs for their yield strategies are fronted by their UK legal entity. This will be transferred to the DAO

Had votes for a treasury management committee earlier this year. There should be a mechanism in place for electing new committee members down the road

Wants to strike a balance between the DAO having oversight on what is going on and decision-making

Could have something like MakerDAO’s Core Unit System:

Different functions become a Core Unit

Core Unit presenting to the DAO about the plan for the next quarter, half a year, etc.

Their DAO has completed 10 votes so far, with a referendum-style DAO voting

Last Thoughts

Partnerships are very important to them

In the roadmap, they stated that they wanted to build more wallet integrations

Everyone that comes into the crypto space requires a wallet. Hence, their focus on wallets

All information presented above is for educational purposes only and should not be taken as investment advice. Summaries are prepared by The Reading Ape. While reasonable efforts are made to provide accurate content, any errors in interpreting and summarizing the source material are ours alone. We disclaim any liability associated with the use of our content.