Zima Red ep 77: Yan Liberman

$1m into +$100m: Building The Ultimate Crypto-Native Investment Firm

Primer: Delphi Digital is an independent research boutique providing institutional-grade analysis on the digital asset market. They have grown tremendously over the past couple of years. In this episode of the Zima Red Podcast, Andrew Steinwold speaks with Yan Liberman, Co-Founder of Delphi Digital, on their journey to where they are today.

Origins

Worked in equity research covering TMT at Bloomberg

Moved over to Deutsche Bank to do leveraged finance

Got into crypto in May 2017 with his current co-founders

Researching crypto while still in their TradFi jobs

"And before you know it, you're just like emptying out your entire traditional equity portfolio. And then not too long after that, my entire retirement portfolio, is like, yeah, this is way more interesting." - Yan Liberman

Rode the highs of 2017 and the lows of 2018

Thought of getting into the space professionally in 2017

Left their TradFi jobs in 2018 and used their savings to bootstrap their business

Initial Attraction To Crypto

In 2017, it was the opportunity to make a ton of money. To do so, it requires them to learn about the space

The more they learned, the more they realized that crypto is a really interesting space. Wanted to be a part of it in the long run

Delphi Digital

His Co-Founders

Been roommates for many years

Very close to one another. Would not bottle up and hold back opinions

Spent the day working in their TradFi jobs and their nights building up their business

Thought Process Behind Starting Delphi Digital

They have never managed capital before, so they avoided that route

Thought that research was the best way to start

Wrote 20-30 pages reports to deep dive into a handful of projects. Helps them to really understand the topic

Goal: start with research —> really understand the space —> grow business —> move into managing capital

Tom joined in February 2019

Did not have the budget to spend on advertising, so they released 2 large reports for free to build their brand

Bitcoin report calling for the bottom of Bitcoin based on UTXO analysis

Eth report

Started subscription model after that. Did consulting work on the side and got involved in great projects early on

Their stash was running out and their lease was up at the end of March 2019

Happened to land a big consulting job to stay in New York

Through 2019, they started bringing on employees

Eventually reached a subsistence stage where they switched from taking capital to fund operations to payment in tokens

"One project launching without a token is actually disadvantage relative to one launching with a token, because now this token is an asset that you can use to incentivize behavior and kind of align interest and a really useful kind of coordination mechanism for a lot of the different individuals interacting with the protocol, because you have to kind of assume everyone acts in their own best interest." - Yan Liberman

Who Was Responsible For Research

Everyone was involved. Not enough time/manpower to leave research to just 1 person

Ended up recognizing each individual's skillset and they specialized in the areas where they excelled

In late 2019/early 2020, Anil shifted to the COO role where he excelled

Kevin was an equity strategist before. Hence, his focus is more macro in nature

MJ and himself would focus on long form research; Yan would focus on the quantitative side while MJ would focus on the qualitative and tech stack side

Plenty of overlaps between different entities in terms of IP and work done. Would repackage and publish the content to make it actionable for clients

To reduce choke points of multiple individuals reporting to one person, they created some hierarchy within the workflow

Delphi Labs

Became more selective with their consulting work. Shifted to consulting for equity. Wanted to be aligned with the projects over the long term

Partnered with Jose and Luke in mid-2019. Consulting side evolved into Delphi Labs

Previously, they would design tokens and work with projects. The engagement would conclude with the handing over a model to the project. They did not have the technical skills to go further than that

Brought on more developers and analysts. They are now able to design the token economics and code up the smart contracts

Delphi Ventures

Began looking around for potential investors in mid to late 2019

Discussed with a seed investor but the deal fell through

Decided to seed it themselves. Everyone chipped in and they raised $1 million

"Our biggest value add is finding projects early on, and really figuring out what makes sense and what can accrue value and really trying to secure that massive, like asymmetric upside return by getting in as early as possible." - Yan Liberman

Recycled capital when some positions were sold off. Proceeds were used to reinvest

Over time, the investment landscape has grown and the deals are getting larger

Launched Institutional Plus model to allow subscribers to co-invest alongside them

Current AUM: mid to low 9 figures

Sourcing deals:

Some are brought to them

Partnering with other funds

Reaching out to founders

These days, having capital is not enough. Their value-add is to provide advice on tokenomics

Delphi Podcast

Tom joined them early on and was already running his own podcast

Tom's podcast evolved into the Delphi Podcast

Created subcategories for the podcast where individuals who were subject matter experts would be the interviewer for the episode

Piers: NFT

Kevin: Macro

Yan: DeFi and Gaming

Tom: Jack of all trades

Their Hires

Have no external investors

Owns all 3 of their entities and able to recycle capital and share IP across them when needed

Hires can be plugged into a specific area in the most efficient way

Incentive structure for analysts to bring deals to the Venture side

"The value prop we can offer prospective hires is really compelling in the sense that they'll be part of the hive mind that is Delphi, and we're constantly talking through everything that's going on in the market, and, and that all becomes really actionable for them in their individual portfolios." - Yan Liberman

Hires can participate in projects they incubate through Delphi Labs

Hired a few guys based on their degen score

Designing Token Models

It is a learning process involving tweaks to previous designs

Try to model the design, play it out with different variables, and observe what happens

Attacked their models and attempted to exploit them from the perspective of extracting the most value for themselves

Did A Background In Finance Help?

Was reasonably helpful

In DeFi, the initial models were DCF-based and it made sense for these models to be used

Token design and gamifying incentives. Being a video game or poker player helped to some extent

Spoke the same language with institutions and able to gain credibility immediately

Finance background eventually became obsolete. Had to understand how models progress over time and why

Sector He Is Most Excited About

Gaming

Excited about being able to invest in Yield Guild Games

New capital for gaming will come from:

People who want to play the game for fun

People who want to play-to-earn

Play-to-earn games attract more gamers which, in turn, attract even more gamers to it. Blockchain games will outgrow traditional games since the latter are walled gardens

Yield Guild removes the barriers for the play-to-earn community to come into the space

Users will be sticky to Yield Guild and future games would want to partner with them, creating a flywheel effect

What Is The Next Big Thing

Social tokens will come into play

Could be a characteristic that's added to existing tokens (e.g. reputation based on games played, achievements, etc.)

Have to tease apart whether the social element will be its own category of social tokens or a facet of existing communities

Thinks that there needs to be a flourishing ecosystem in place before a social token can be introduced

Thoughts On The Metaverse

To some extent, the Metaverse is already here

The younger generation are digital natives

Trend towards the Metaverse will get stronger as it becomes easier to get online/have access to a smartphone

Grand 5-10 Year Vision

Doesn't set goals beyond 1 year as the space changes too fast

To continue to grow Delphi

Favourite Video Game

Played a lot of video games (Age of Empires, Diablo, Starcraft, SimCity, WoW, Halo franchise, Clash of Clans)

If he had to pick, he would select Halo 3 as his favourite game

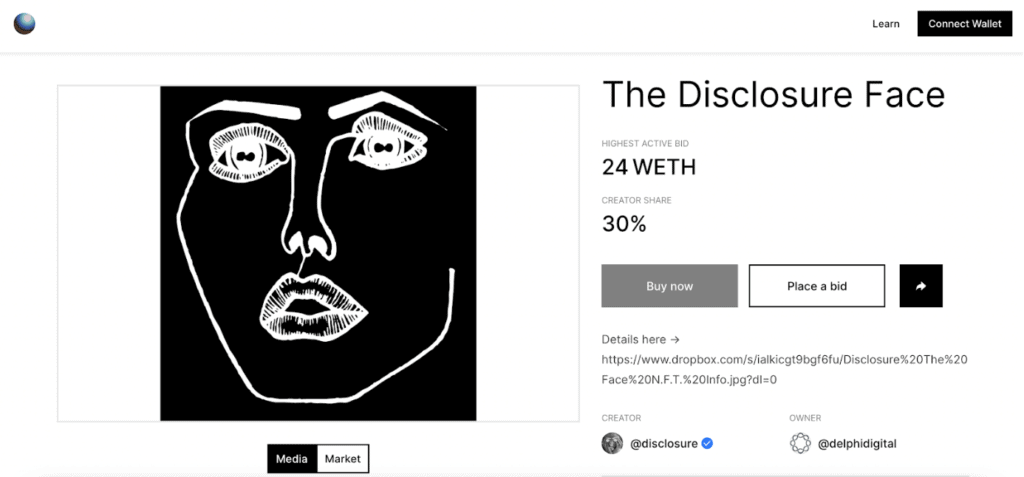

Single Favourite NFT

Disclosure NFT, where the holder can get free access to any Disclosure concert

Axies

Most Controversial Thought On NFTs

Have not done as much investing on pure collectibles

Bigger fan of NFTs with embedded functionalities

For pure collectible NFTs, one has to be ahead of mimetic trends and be able to identify a sticky community

Most pure collectible NFTs would end up dying off over time

If You Could Improve Something In The NFT Space

NFT launches need to become more fair with a better distribution mechanism

Creating a stronger community for more staying power

NFT Space In 3 Years

Expects it to be larger

Thinks that there will be upside on infrastructure plays on the NFT side

Bullish on play-to-earn economies

"I think that the gaming economies are going to get really large, and you're going to see, like valuations for gaming projects exceed traditional world economics, or traditional world games." - Yan Liberman

All information presented above is for educational purposes only and should not be taken as investment advice. Summaries are prepared by The Reading Ape. While reasonable efforts are made to provide accurate content, any errors in interpreting and summarizing the source material are ours alone. We disclaim any liability associated with the use of our content.